Real estate relief programs are available for those affected by COVID-19

This is a huge opportunity so please take advantage while this limited-time program is available. Remember, most alternative lending options have dried up at the moment, and with the government planning to assist a lot of the businesses affected by the virus in the coming year, this would be a perfect bridge to an SBA loan.

• Restaurants & Bars

• Gyms & Fitness Centers

• Hotels, Motels & Inns

• Retail Shops

• Entertainment Venues

• Travel Businesses

• Educational Services Day

• Care Centers• Start Up’s• Virtually All Industries!

• No Payments For 3 Months!

• Interest Only Payments For 12-Months!

The best part about this program is that it allows us to lend even if the merchant is shut down or has little to no cash flow. Basically, we’ll assess all of your cash flow before COVID-19 pandemic. The program lends up to $2,000,000 at 4% per month with the first 12 months interest only and the second 12 months regular principal and interest payments (amortized over 48 months to keep the payments reasonable in month 13).

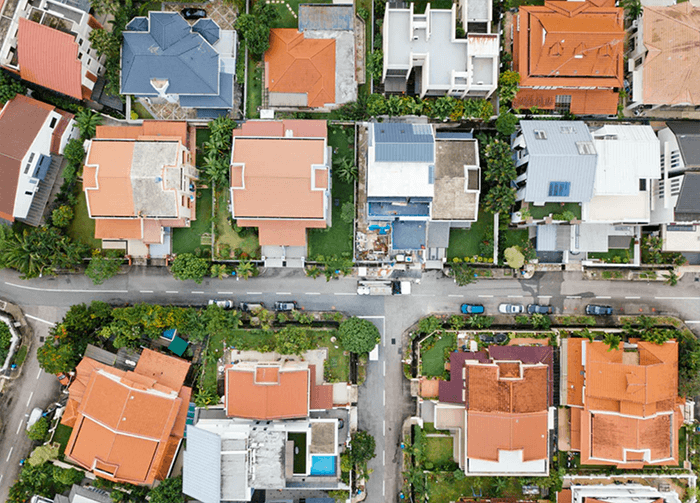

To qualify, the merchant has to put up real estate as collateral…just about any property will do. If we are in the first lien position, we can lend up to 70% of a residential property’s value or 65% of a commercial property. If we are in a junior lien position, then we can lend <65% CLTV. Everything is subject to the underwriter’s discretion.

Collateral

Acceptable: virtually any combination of real estate may be used as collateral. This includes commercial, industrial and residential properties including properties under construction, parking lots, gas stations, co-ops, mixed-use, farms, etc.

Unacceptable: raw land, cemeteries, casinos, cannabis farms, churches/synagogues, etc.